The ideas behind crypto are revolutionary, however, they are not that hard to get a grasp on once sufficiently considered. At the most basic level, it is useful and beneficial to think about just three powerful fundamental crypto ideas: (i) decentralized money, (ii) a decentralized financial system, and (iii) a decentralized Internet. The basic idea is decentralized money, hence we got the ‘currency’ in cryptocurrency. The other two ideas apply it in two different domains - personal finance and digital communications, as a strategy to achieve distinct specific goals.

This blog post was inspired by this recent nice nakamoto.com blog post It Will Take Years for Smart People to Understand Cryptocurrencies.

Idea #1: Decentralized Money - not your mother’s money…

Here we mean decentralization, as in no centralized entity arbitrarily controlling the currency supply in a financial system. More concretely, what we mean is decentralization, as in no central bank control over the money supply and no central entity deciding what money is legal or illegal for people to use.

A cryptocurrency is decentralized software money. The decentralization is absolutely key: centralized or federated payment systems such as Libra or Ripple are, by definition, not cryptocurrencies - although their marketers would like you to believe otherwise. In decentralized money, the supply and distribution of the currency are encoded in software algorithms, and these algorithms are executed by a p2p network of computers under a fundamental security assumption regarding the honesty of the entities who control the computers which run the software.

From a political science perspective, we can say that the algorithms are the judicial branch and that a p2p network of computers is the executive branch, tasked with enforcing the enacted laws in practice by executing the algorithms, starting from a mutually agreed upon initial starting point that in crypto-speak is called the genesis.

Decentralized Money is important for Freedom

“Man is born free; and everywhere he is in chains” - Jean-Jacques Rousseau

“free” as in “free speech,” not as in “free beer” - Richard Stallman

People start using decentralized money by either getting paid by it, by making payments with it to someone else, or by starting to save funds for the future with it. When they do so, they gain the predictability and determinism of software algorithms that sets the supply and the inflation and they don’t need to trust the government or the central bank of their nation state to not cause their funds to lose considerable value over time. This is not an abstract argument. People in many countries have lost their life savings due to hyperinflation caused by failed governments. This kind of software money is also often called sound money by the crypto-community. Where by sound we mean sound as safe and not sound as audio.

When you only use your state-issued money, you are completely subject to your government’s arbitrary devaluation of your money due to a monetary policy which may be very bad for that money’s stability, such as bailing out private banks and insurance companies that are about to go bankrupt. Some can invest their savings in non-cash assets, protecting them from inflation. However, this is often a viable option for the middle and upper economic classes. The poor and working class rarely accrue enough capital to be able to invest. And any ‘investments’ they make in assets - such as a house, apartment, or car - is usually done by going into debt.

One can argue that in a democracy, the monetary policy which controls the inflation of a national currency is part of the actions of an elected government - one that is supposed to balance the interests of all individual subjects with what it perceives to be the interest of the broader society. So, hypothetically, you agree to lose the value of your money over time to help your state economic system to function. But what happens if you live in an authoritarian regime?

As of 2020, about 4 in 10 of people on earth (that’s 3.3 billion people) are subjects of some form of a dictatorship. So, at a minimum, financial freedom from the state allows these unfortunate people to stick it to their dictators, to reduce their dependence on the regime’s corrupt institutions, and to bypass arbitrary rules that prevent them from being fairly compensated, compensating and transacting freely with others, and saving money that they’ve earned fair and square.

Freedom is important for creation of a better possible future for humanity

“The matrix exists, it just doesn’t look like it did in the movie” - @tristanharris

Without freedom for humanity to work on advancing one or more different plausible futures, there can be no plausible futures where we aren’t doomed to live in the manner that people in power dictate to us, or one that we blindly stumble into as individuals and as societies. If you don’t believe in this, then you can just keep stumbling along life towards a future that somebody else set for you. It may sound depressing, but most people live their life like this. For those who want an alternative, decentralization provides a way out…

Decentralized money - no cartel control over money supply or over who can transact…

So, we have removed the nation state’s central bankers and have magic Internet money. This is a great start, but by itself is still insufficient. We must ensure that we don’t just replace the old boss with a new boss (or bosses).

An important role of decentralization algorithms is to prevent a cartel of powerful entities from controlling or manipulating the money supply, and from being able to determine who can and who cannot transact with that money. This is one of the critical design problems of cryptocurrency systems old and new, as already noted by many, many people who think about decentralization. This issue is often called the centralization problem. If such a cartel can exercise such control over the currency, then we haven’t achieved what we set out to do. We want decentralization to be our new overlord.

This problem is particularly acute with proof-of-stake-based cryptocurrencies, where a central entity needs to somehow fairly distribute the currency between many entities to avoid centralization and the system needs to somehow be designed to avoid creation of a small number rich and powerful entities which controls the majority of the stake. As of 2020, it is still to be seen if we can have a decentralized proof-of-stake-based cryptocurrency. For proof-of-work based systems such as Bitcoin and Ethereum, by contrast, the problem of centralization chiefly centers around mining itself. A lot has been written about mining monopolization and centralization. It is clear this is a hard open problem that is yet to be solved by crypto technology.

Does anybody care about decentralized money?

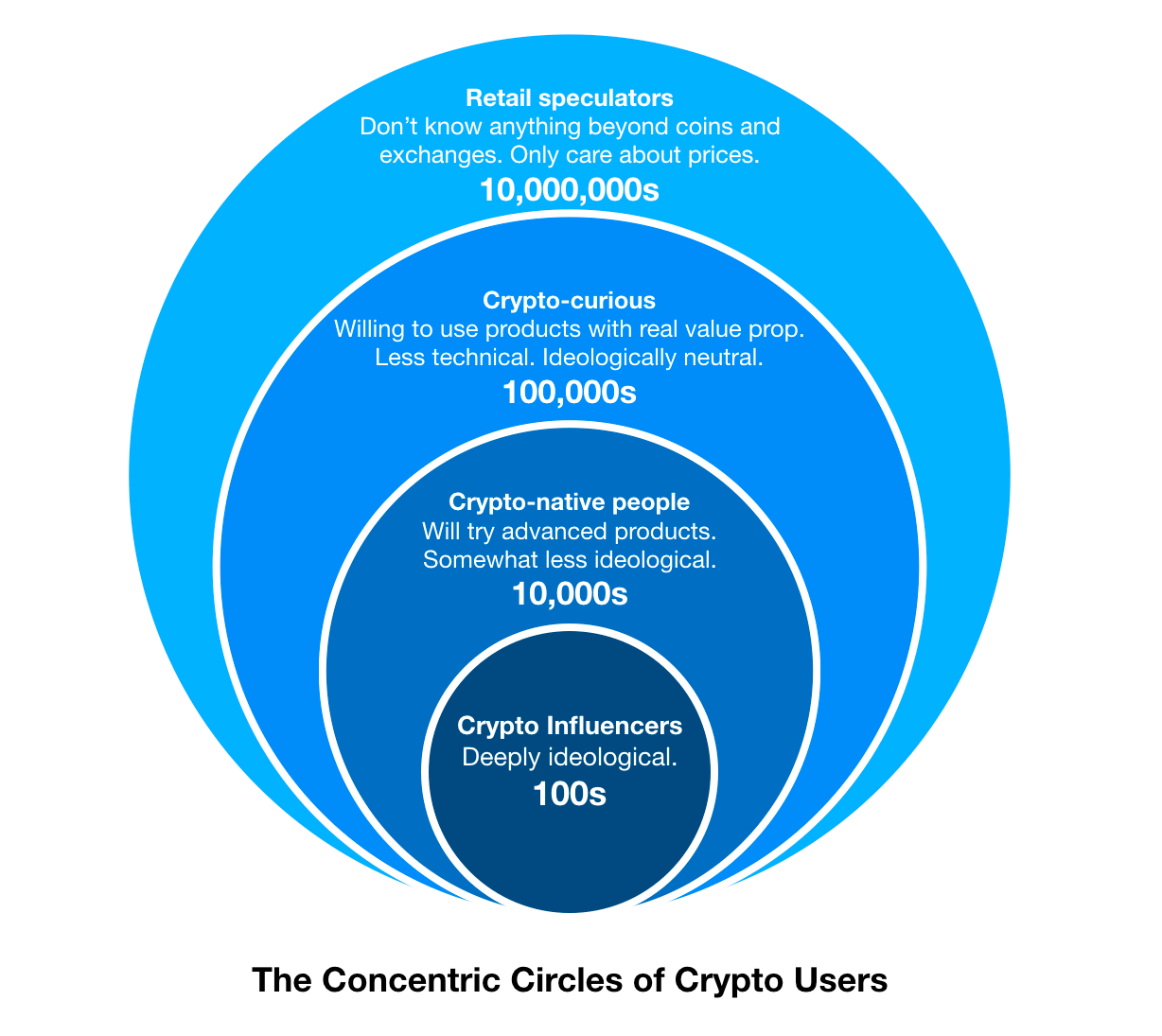

This is one of the key questions that we need to ask ourselves. People who want to escape from nation-based currencies certainly do. It is worth considering the numbers in this nice infographic from Haseeb Qureshi:

As of 2020, there are likely a few hundred thousand crypto-curious people who think to various extents that decentralized money is a good idea worth exploring, and who will probably support new decentralized cryptocurrencies, provided that they work as advertised. Note that there are likely tens of millions who only care about cryptocurrencies as a speculative asset investment class. These tens of millions make a lot of noise on social media platforms by sheer numbers and so they often mask more intelligent concrete discussion about the merits of decentralized money.

It is fair to say that there will always be 100 people who want to get rich quick for every 1 person who want to better humanity and society in the long term and beyond his lifetime.

Idea #2: A Decentralized Financial System

Once we have a decentralized currency, we can build a decentralized financial system which uses that currency as the base layer. Your bank is not just keeping your money, after all; it also provides financial services such as loans, mortgages, credit cards, retirement planning, etc.. In a mature decentralized financial system, people can opt into such services without using any banks.

For example, use a financial service for savings, entering into a two-way payment relationship with a service provider, for taking a loan or for exchanging tokens derived from the base currency. Decentralized financial services are important and there’s a lot of innovation in this area in the crypto space. On a technical level, they are made possible by smart contract transactions or by special kinds of crypto transactions.

The main issue with decentralized financial services is that they require a strong base decentralized cryptocurrency, and if the base currency is not sufficiently decentralized, then the financial system is certainly no better than the base it is built upon.

Does anybody care about a decentralized financial system?

Unbanked people of the world most certainly do, in so much that a decentralized financial system can give them access to basic financial services, as basic financial services are a key part of breaking out of poverty and having more agency over their lives. People who want a decentralized currency to be something beyond mere digital gold also do. Hundreds of thousands crypto-curious people will also start using decentralized financial services when they will be available as a supplement to a cryptocurrency that they trust.

Idea #3: A decentralized Internet

When we talk about the Internet, we can roughly say that it consists of several kinds of Internet services, such as content publishing, social media, and digital communications. So, we are talking about Decentralization, as in no centralized control of social media and digital communications…

When we talk about a decentralized Internet, we talk about an Internet that works very differently from what we know today as ‘the Internet’. A decentralized Internet will have a new network architecture, and protocols which will enable new and different kinds of Internet services. For example, social networks and instant messaging services which are not provided or controlled by one service provider, but rather by a federation of service providers that are connected together in a mesh network and provide services according to well-defined network protocols.

Cryptocurrencies are just one building block in the creation of a decentralized Internet, but they are a critical one. If the Internet is a thesis, then we need to conceptualize an antithesis to create a new synthesis. We can create this antithesis by inverting the core design principles that led us to where we are today with the Internet. More on this below…

Does anybody care about a decentralized Internet?

There are about 7.8 billion people living on Earth today, and 4.5 billion of them use Internet services. Yet it is clear to a growing number of people that the Internet has mostly gone off-course in the last decade, and humanity needs to have an alternative.

We are facing very serious issues due to our world being ruled by a small number of ultra-powerful centralized social media and Internet communications corporations. These include control of massive amounts of personal data, the undermining of democracy, and a risk of severe polarization - to the point that people no longer agree about the basic facts of reality. To learn more about these problems read the excellent editorials in the NY Times privacy project. Read about the serious dangers involved in hyper news personalization in this blog post from Douglas Rushkoff. Look at the good work that the center for humane technology is doing. Read The Four by Scott Galloway. Read Team Human and Life After Google. These people are your friends and are on your team. CEOs of public Internet companies are not your friends and are not on your team.

Designing a Decentralized Internet

There are two useful strategies we can employ to design a decentralized Internet.

Strategy #I: Decentralization via a systematic inversion

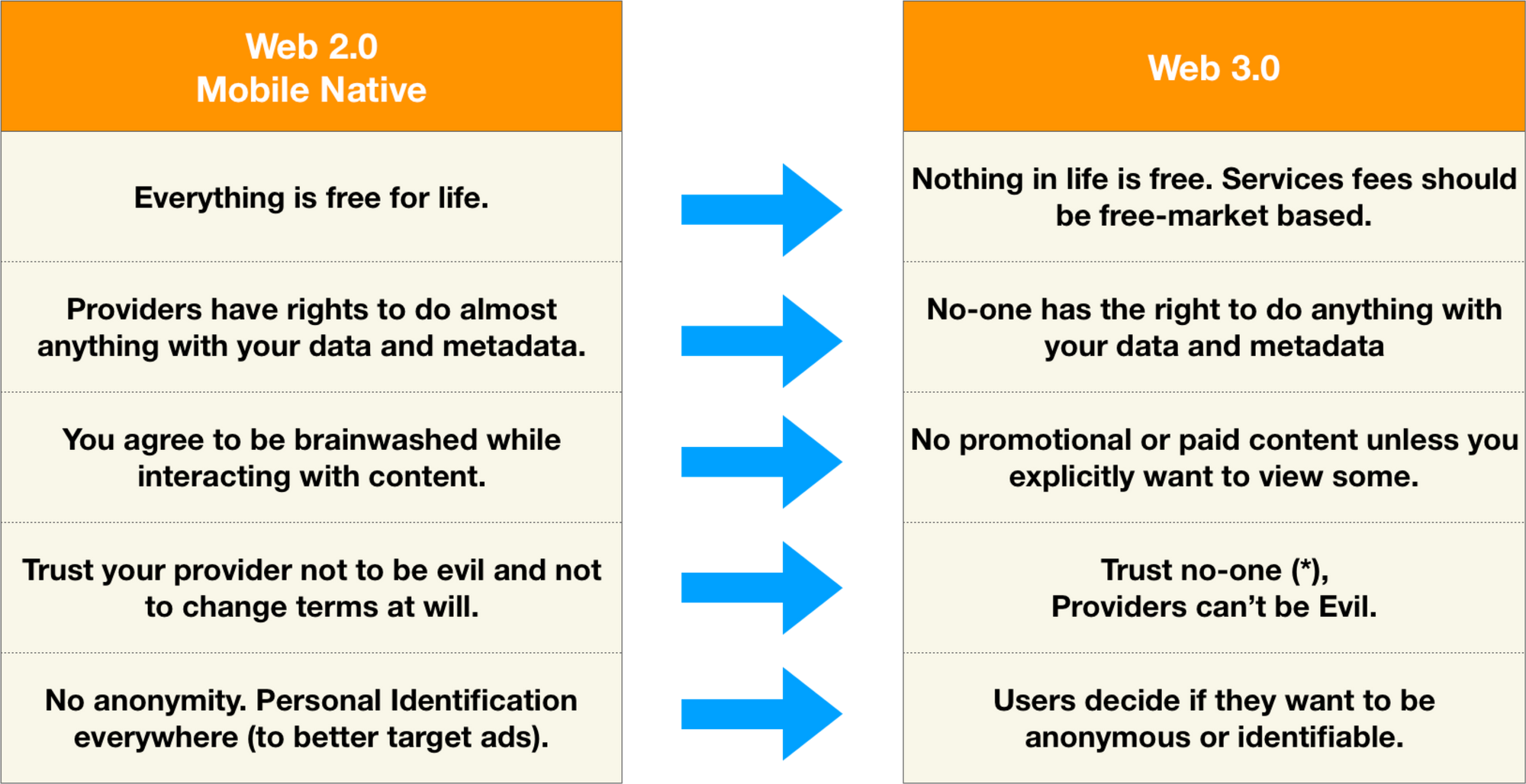

First, lets methodically review the core principles of Web and mobile services, and propose alternative inverted principles. These new principles will guide us in designing the Decentralized Internet. Without first defining such principles, designing a better Internet is impossible.

There are several interesting thinkers who already started to explore hidden structure and principles of the current system. Among them, Scott Galloway in his book The Four: The Hidden DNA of Amazon, Apple, Facebook, and Google and in lectures such as this one, and George Gilder in LifeAfterG∞g≤:TheFallofBigDataandtheRiseoftheBlockcha∈EconomyLifeAfterG∞g≤:TheFallofBigDataandtheRiseoftheBlockcha∈Economy and in lectures such as this one.

I’d like to propose the following systematic inversion.

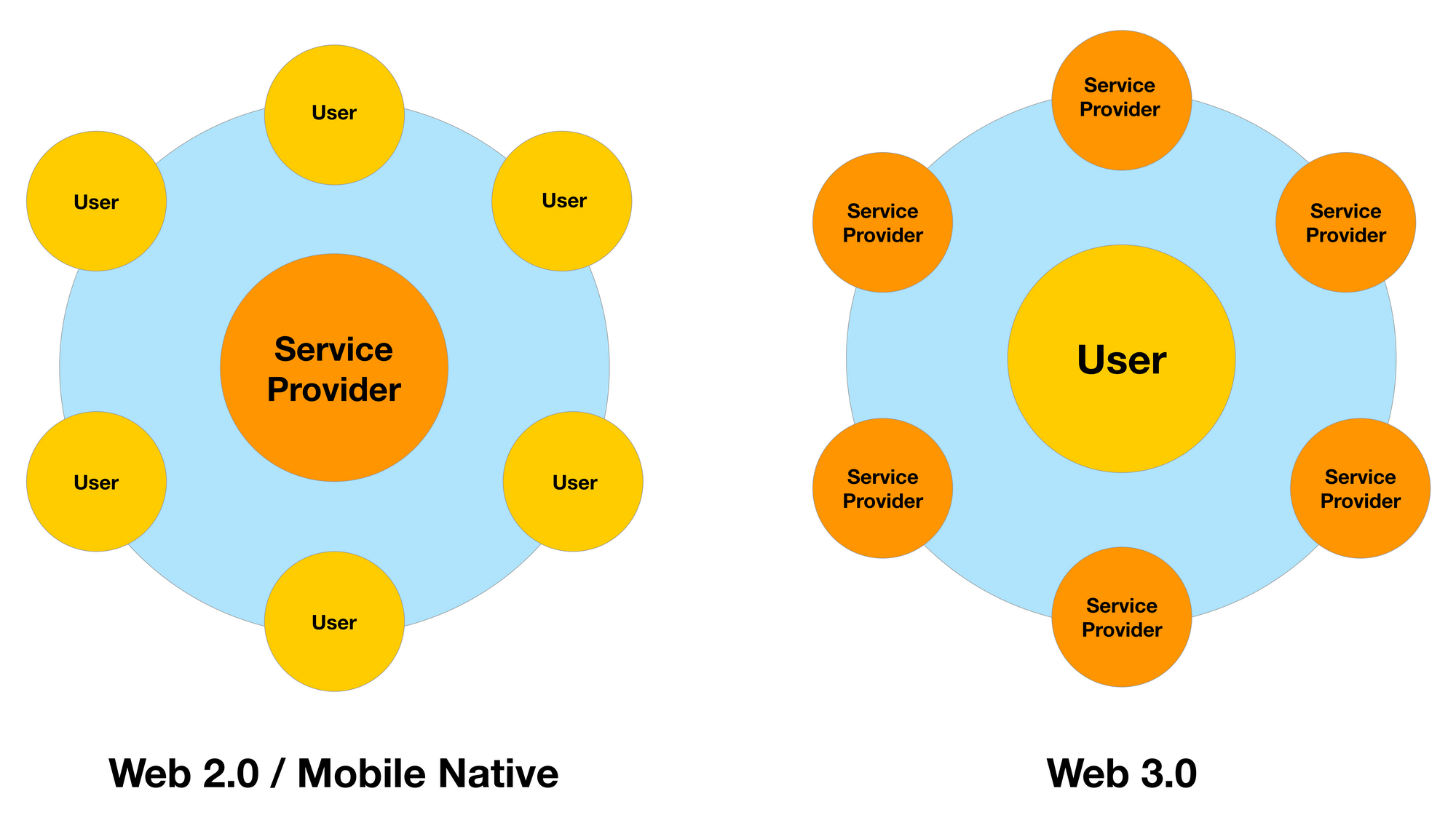

Once we have new inverted principles to guide us, we can move on and propose a more concrete, inverted network topology that supports them. For example, we can propose an architectural inversion that replaces the conceptual roles of users and service providers in a digital communications system. Similar to the copernican revolution, which inverted what’s in the center of the system and what’s in the edge (maybe we can call it the decenter?), we can propose a network architecture for an Internet where the relationship between service providers and users is inverted:

When we design a new user-centric Internet, the service providers become secondary and should be easily swappable by users. The service provider actually lives up to its name, providing a service, as opposed to its current status as the master who owns them. The user likewise becomes more than ‘just a client’.

For most network protocol designers, this inversion probably seems a bit too abstract - but remember that these are mostly guiding principles, designed to inspire us to build good protocols. Once we have established this conceptual inversion, we can focus on creating more concrete design requirements that reinforce them.

For example, the inversion principle instructs us that our protocols must address the issue of a malicious service provider trying to become centralized by diverging from the network protocol of the service it’s providing. To address this issue, we set a design requirement that states that users should be able to easily swap service providers with minimal network service disruption.

With this principle established, we can now design a network protocol (or several) that satisfies this requirement to provide it as a feature of our new Internet. For example, service providers discovery protocol, data migration protocol, service providers provisioning protocol, etc…

Strategy #2: Decentralization via cryptocurrency

It is useful to imagine the decentralized Internet not as one network with a new set of protocols, such as the Internet as it exists now, but rather as an umbrella concept that describes the availability of new decentralized network services such as social media, cloud storage, and instant messaging. These network services would in turn use decentralized protocols and build on top of the Internet’s core protocols, such as IP, TCP and UDP.

Here crypto is an important building block in the design of the decentralized Internet. Cryptocurrency is a support technology that enables alternative business models and network architectures that wouldn’t be possible without it.

For example, it can allow for the replacement of ad-based revenue models with a nano-payment revenue model - per unit of content consumed or per network service provided. Think micropayments in smaller units. E.g. $0.01 USD per transaction.

The supportive nature of cryptocurrency is not a silver bullet, however; it is just another tool in our belt when we want to design fairer networks with sustainable business models. There’s no such thing as a free lunch, and service providers need to at least cover their costs, and in most cases profit, from providing services to users.

Nano-payments as a revenue stream can be enabled by payment channels technology. A payment channel is a crypto technology that enables two or more parties to transact a large number of small payments amongst them without any transaction fees, and periodically settle their balance back to a cryptocurrency ledger. This is just one example of how crypto provides us with a concrete and viable alternative to today’s subscription services or ad-based Internet business models.

The way that cryptocurrencies and their payment channels enable us to compensate service providers on the API level is unprecedented. Running a cryptocurrency in a p2p network between service providers is just one component that enables all of this higher-level functionality.

The use of cryptocurrency as the fuel of our new kind of network enables us to build incentive-compatible protocols. In an incentive-compatible protocol, it makes economic sense for a rational, self-interested service provider to follow the network protocol that everybody else on the system follows.

This important incentive compatibility property enables us to design networks where it is rational for the service providers to behave in a predictable way, which ensures the other network properties such as privacy and data delivery.

What is envisioned here is a whole new generation of decentralized services such as social media, cloud storage for personal files, and instant messaging platforms, each with their own unique design decisions which balance between different competing concerns such as convenience, security, performance, and privacy.

Summary

To summarize, this post sketched an explanation as to what cryptocurrencies are and why they are important using three key ideas: decentralized money, a decentralized financial system and a decentralized Internet. I hope that these ideas can serve you as guides on your quest to better understand crypto, what it enables, and why these ideas - and their potential - are so important and powerful.

Thank you Yael Hoffman and Lane Rettig for the help on this post.

Join our newsletter to stay up to date on features and releases