Dear Smeshers,

We take our economics very seriously. A blockchain like Spacemesh is many things to many people, but one of the clearest and most important is an economic engine. We built Spacemesh as a step towards building the sort of world economy that we want to see and participate in: one that’s a bit more open, a bit more transparent and participatory, and most of all one that’s a bit more of a level playing field than both the existing “off chain” economy and incumbent blockchains.

When designing and building Spacemesh we did our best to come up with an optimal economic model and set reasonable parameters, such as the half life that describes the shape of the issuance curve over time. The Spacemesh economic model is both inspired by and modeled after Bitcoin: like Bitcoin, Spacemesh issuance gradually decays over time, but it does so over a much longer time horizon than Bitcoin. We feel this both addresses potential economic problems with the Bitcoin economic design and also disincentives hoarding by leaving more coins on the table for even small-scale miners who join many years after genesis.

As we first described in our initial announcement of the Spacemesh economic model a couple of years ago, at the time of genesis we placed 150 million $SMH coins into on-chain “vault” contracts. These coins represent the share of coins—6.25% of the total, eventual issuance of 2.4 billion—that are reserved for the early team and investors. For the first year post-genesis (i.e., until July 2024) these coins cannot be moved; this is guaranteed by the code of the Spacemesh blockchain. After this point the coins begin to vest gradually over a three-year period, after which the vaulted coins are fully vested and fully accessible (and thus enter the circulating supply). We designed the vesting this way to ensure that Smeshers have a head start: the only coins that circulate for the first year after genesis are coins that have been mined by Smeshers. The way the vault contracts were designed, at the one year mark, 25% of the coins in the vault become immediately accessible—i.e., the on-chain vesting has a one year, 25% cliff.

Spacemesh won’t achieve its lofty objectives without input from the community on the right path forward. Many community members have understandably expressed concern with the large, sudden coin unlock that occurs upon the first anniversary of genesis. Unlocking 25% of the vault coins means that 37.5 million coins suddenly enter circulation. This would mean that the circulation would increase by 82% overnight, and that around 44% of the coins in circulation post-unlock would be vaulted coins (the rest would be mined coins).

We’ve been listening and we haven’t taken the community’s concerns lightly, and have been working behind the scenes to see what we could do to address them. We discussed the situation with the team and with the investors, taking into consideration community concerns and the long term health of the Spacemesh ecosystem. We’re excited to share that we’ve achieved internal consensus on removing the vesting cliff and smoothing out the vesting schedule of the vaulted coins and that we intend to put forward a formal proposal to this end to the community.

We generally feel that, like Bitcoin—and in order to achieve the maximum credible neutrality in governance—the economic model shouldn’t be changed post-genesis. To be clear, this proposal does not change the Spacemesh economic model. It would have zero material impact on long-term economics. No new coins would be issued, and it would not involve changing the balance or state of any accounts. (More in a moment on what would change.)

It’s a small change with a large positive impact: by removing the large vesting cliff and smoothing out the vesting we’d remove the large, sudden economic impact described above. During the first two-week epoch following the one year anniversary of genesis, only 1.4 million vaulted coins (or about 3% of all circulating coins) would vest, rather than the nearly 39 million (44%) that would vest with the cliff. This would adversely impact only the team and investors, and would have a clearly beneficial impact on the rest of the community.

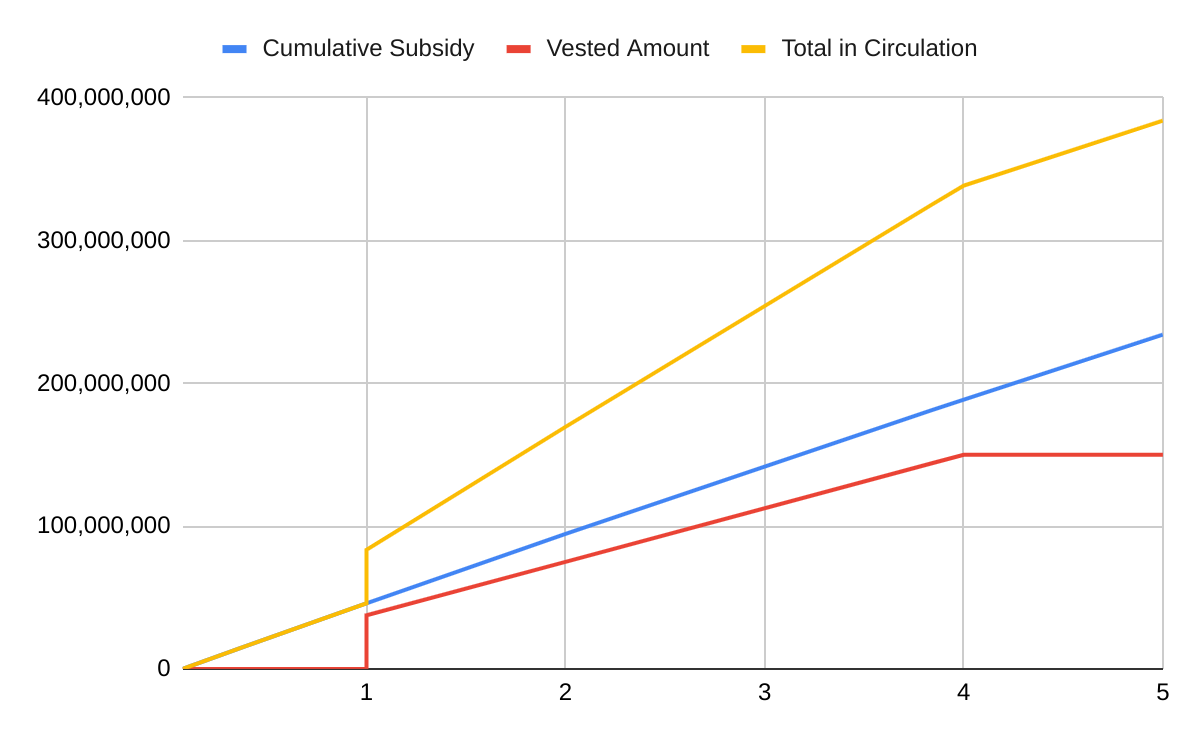

Circulating coin supply, first five years, before proposed change

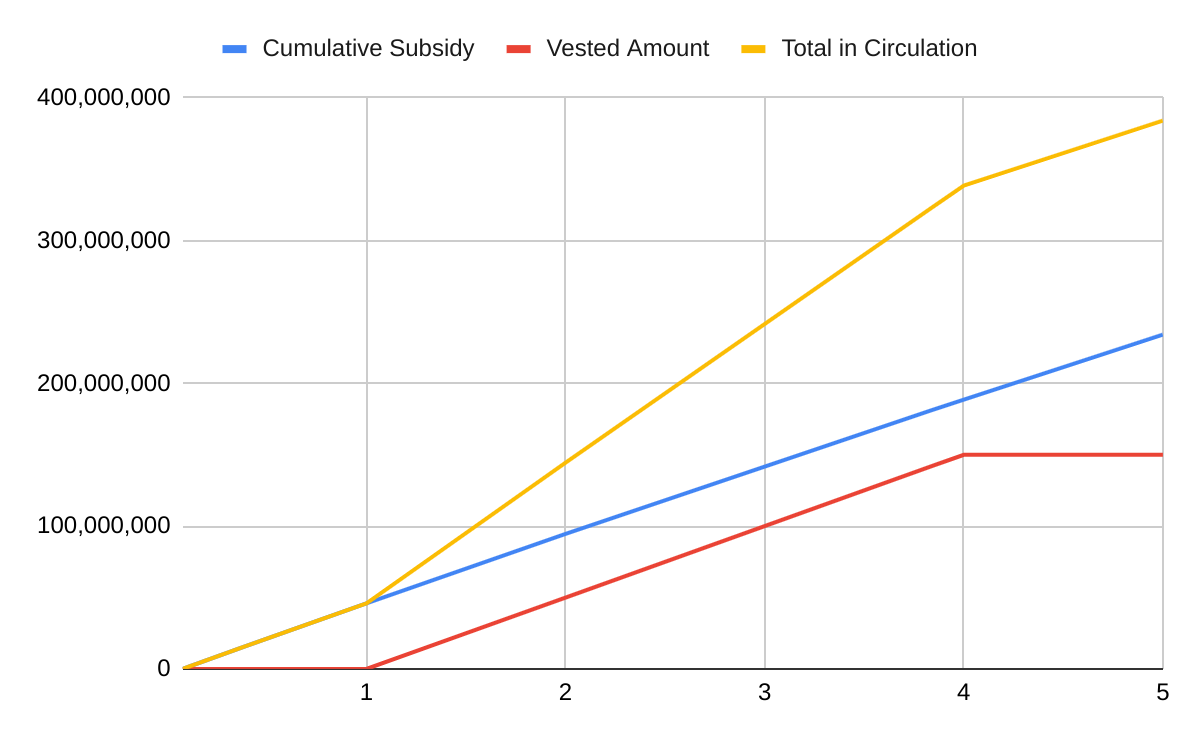

Circulating coin supply, first five years, after proposed change.

Note that the blue line (subsidy) remains unchanged, the vesting cliff is removed, the slope of the red and yellow lines (vested amount, and total amount in circulation) changes slightly between years 1-4, and that there’s no change whatsoever after year 4.

As we’ve said many times before, the governance of the Spacemesh protocol, including its economics, is ultimately in the hands of the community. And we’ll continue to put the interest of the protocol and the community first. We’re going to make a formal proposal to remove the vesting cliff and smooth out vesting and we believe it’s in the interest of the community to adopt this proposal. We can propose this change, but it’s up to the community to discuss and ratify the proposal.

Here’s what will happen next:

- In a few days we’ll publish a formal technical proposal as a SMIP (SpaceMesh Improvement Proposal). As mentioned, the proposal will not involve the issuance of any new coins or the transfer of any existing coins and it will have zero material impact on long-term economics. Rather, it’ll involve a small technical change to the VM that reinterprets some of the arguments passed to the vault contracts to effect the desired change. We’ll share this proposal, along with sample code, with the community.

- This will be followed by a RFC (request for comments) period of at least a week during which any community member is welcome to share their thoughts in support of or against the proposal. We promise to take all feedback seriously, positive and negative. Community members are also invited to submit competing proposals.

- At the end of this period we’ll host our first community town hall meeting (most likely on Zoom; details to be announced later). All community members will be invited to participate. During the town hall we’ll explain the proposal, explain our motivation for making the proposal, and briefly discuss upsides and downsides as well as feedback and competing proposals received during the RFC period. Community members who have a strong opinion will be invited to share their opinion during the town hall. Our goals on the town hall meeting are to ensure that all voices are heard, that all concerns are aired, and to achieve rough consensus on a path forward. If we’re able to achieve this on the call, then we can ratify a proposal and decide on a concrete timeframe for rolling it out. If we’re unable to achieve rough consensus, it’s back to the drawing board and the proposal may stall or fail to be ratified and adopted.

Decentralized governance is difficult and messy, but it’s also an essential step towards building the world and the economy that we want to see exist. We, the core team, are stewards of the protocol but can’t make major changes to the protocol, especially to something as sensitive as economics, without the support of the community. We haven’t worked out every detail of how Spacemesh governance will work in the future but we’re excited for this important opportunity to bootstrap the process and get the community more involved!

Join our newsletter to stay up to date on features and releases